Student Loans: Is it Necessary to be Drowning?

As we apply to colleges half of our worries are if we will be able to afford our education. We must decide if we want to go to a cheaper university to ward off loans or go to our dream school and drown in debt for the next 20 years. Sometimes even going to the cheapest university still means being in debt for an extensive amount of time. Many European countries have very cheap or in some cases free education, so why can’t we?

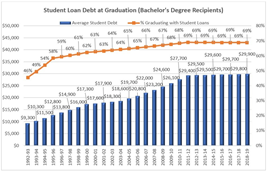

On average college tuition is increasing by eight percent per year according to finaid.org. In the past 10 years, the average inflation rate for The United States increased by 1.9 percent. College is becoming significantly more expensive and the quality isn’t getting noticeably better. When it comes to making anything public less expensive, it falls back on the citizens to pay more taxes. Why should someone who didn’t go to college or has already graduated from college want to pay higher taxes for something that is not going to help them? They shouldn’t.

Having college tuition be less expensive does not mean the money needs to come from the government. Public universities should not be increasing tuition by eight percent each year. Interest is one of the biggest reasons college graduates drown in student debt. If someone consistently pays their bill monthly they most likely will not make a dent in their loans due to the interest rate. The average interest rates are between 3.73 percent and 6.28 percent. If these rates were lowered students would have a much easier time paying off their debt and would help the overall economy of the United States.

Lizzie Padva, Grade 12, Interest/hobbies include skiing and hangout with friends. In the future, Lizzie would like to go to college for marketing.