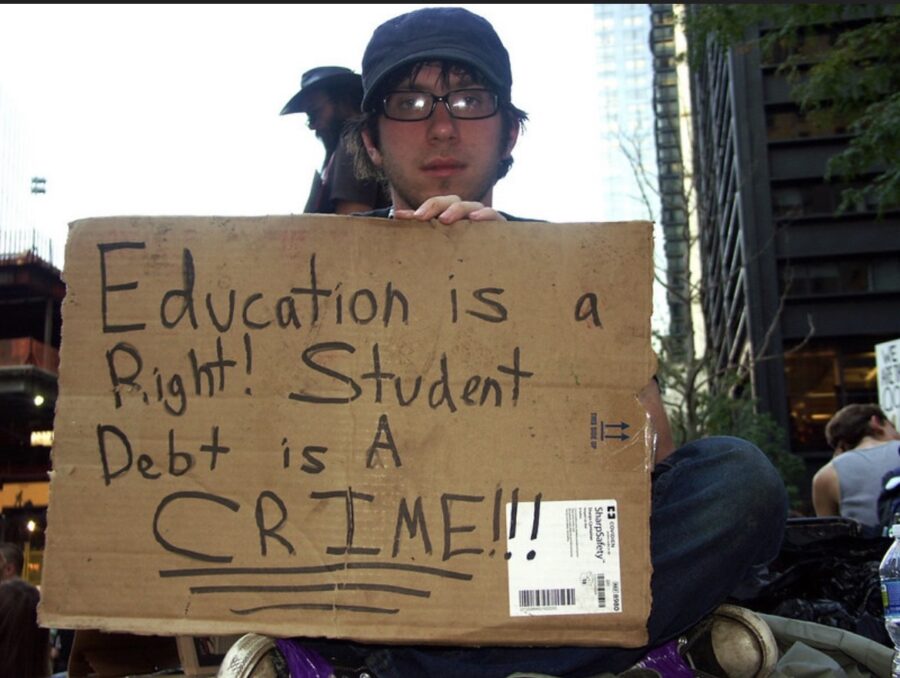

Student Debt Crisis

Student Debt; funds owed on loans taken out to pay for a student’s education. Within the last 40 years, tuition prices have nearly tripled between four-year private and four-year public schools. According to the Department of Education, undergraduate students graduate with around $25,000 in school loan debt. Every year incoming college students need help figuring out what loans, scholarships, and grants they qualify for and can apply for.

With the rates of loans and student debt rising, there are over 1.75 Trillion dollars of student loans in the United States alone, from only 45 million borrowers. Pells Grant is a type of financial aid that students can receive. They once covered nearly 80 percent of tuition costs but now only cover a third of the charges, and even that is pushing it. The pressure of student loans follows you throughout your adult years and your retirement years. Even after retiring, many still feel the pressure of loans and paying them back. From the age of 62 to even older than that, 2.4 million borrowers owe 98 million dollars in student loans.

A Quakertown High School Guidance Counselor, Patty Sabol, states, “Loans are common, but students need to be reasonable in the number of loans they take out. For instance, if a university can find scholarship/grant money or a kid has earned money as a merit award such as academic or athletic, and the amount needed to be covered by loans isn’t a huge balance, then it will be manageable. You also have to factor in the plans of the student. Loan payments are usually doable if a student is headed toward a career with a stable income.” With this, students must consider how much they take out for their education. If there are some costs they can pay on their own, they should consider paying the smaller fees so they are not getting stuck in too much debt. Michelle Levush, a mother of a college graduate student and incoming first-year student, states, “Research grants and scholarships to help offset college cost, work, look for an affordable school and don’t use loan money for frivolous things; use it for education only.” This is a big tip for saving money on college costs; there are many scholarships and grants that any family can apply for, and it is crazy how much you can save from them.

As upcoming generations begin to choose their schools, families, and students, need to consider the amount of money the final costs of education will be and not just the label of it. Many schools are cheaper alternatives than large universities and give the same education. There are community colleges that offer classes cheaper than what you would be paying for at a state university, bringing the overall costs of student loans down. Scholarships and grants are easy to apply for to receive more money from schools. Apply for financial aid through the state. With the help of school advisors and counselors, you can learn more about what grants and scholarships you qualify for.

Sources:

https://www.nytimes.com/2023/04/06/business/retirement-social-security-student-loans.html

FACT SHEET: President Biden Announces Student Loan Relief for Borrowers Who Need It Most | The White House

America’s student loan crisis stems from a war on education as a public good – The Washington Post

Lauren Kuhn, Grade 12. Interests and hobbies include reading, working, hanging out with friends and family, painting and drawing, and traveling. Lauren...