If you were asked to think of luxury items, you might picture designer clothing, high-quality furniture, or expensive vehicles – items that aren’t necessary but provide enjoyment or entertainment. The majority of people wouldn’t consider menstrual products part of that list because they’re a necessary sanitary item for those who menstruate. However, 21 of the 50 states in the U.S. still label menstrual products as luxury items and tax them as such. It’s referred to as the “tampon tax” and is unacceptable in a first-world country.

Taxes bring in revenue for states, so some are concerned about a loss of profit if tampon taxes were to be eliminated. This is a common concern and the biggest problem that states face when eliminating the tax. However, research from Forbes shows that South Carolina, a state that currently taxes sanitary products, would lose approximately $5.9 million in tax revenue out of a total of $4.1 billion that the state collects in sales tax each year. This is a manageable amount, particularly when weighing the benefits for citizens of the state.

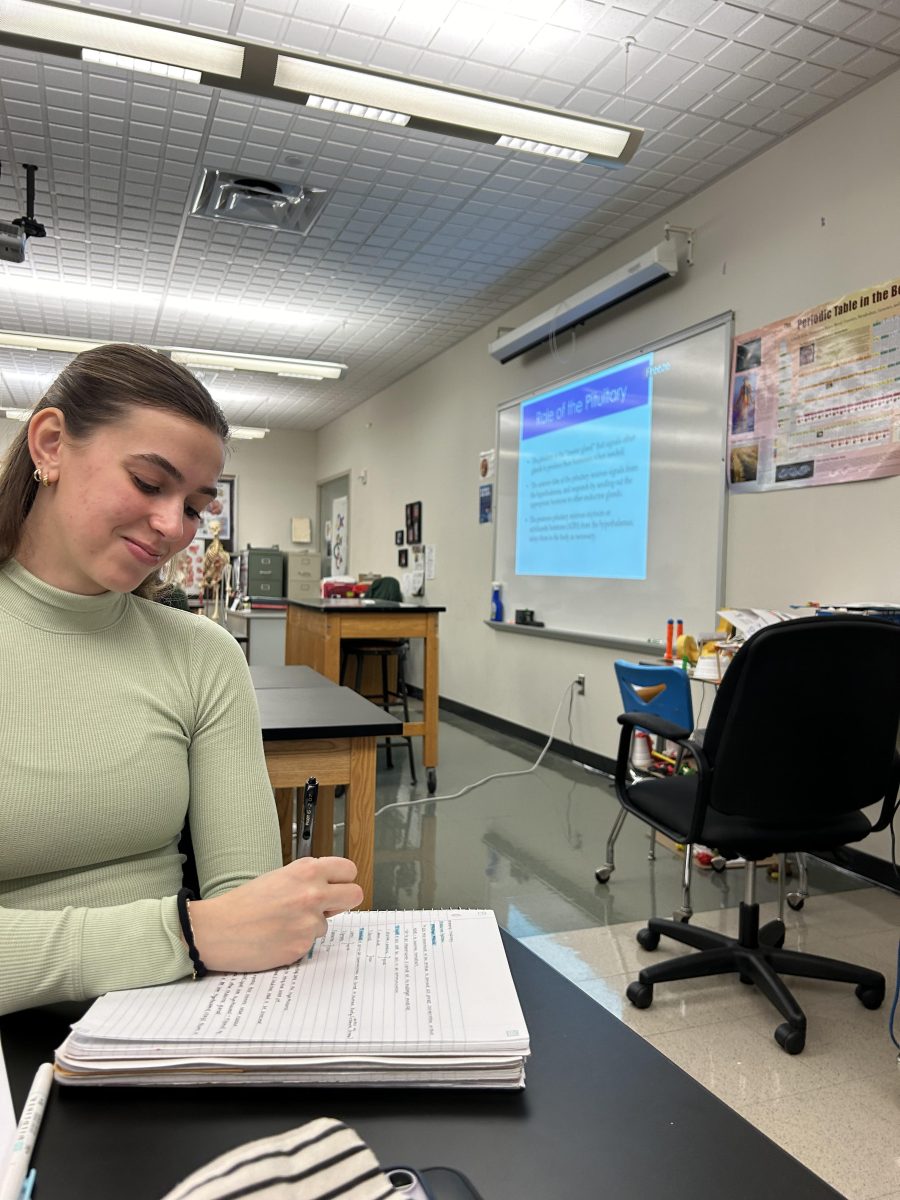

According to research by the New York Times, sales tax in the 21 states that tax menstrual products range from 4% to 7%, meaning that consumers may be paying up to an additional $20 per month or $240 per year on the sanitary items that they need. While the tax seems insignificant on individual purchases, the total amount adds up quickly. This number is particularly large for families of lower socio-economic status. Becky Bowersox runs Mosaic, a group that aims to help marginalized youth in Norristown, Pennsylvania. “We have a lot of families that really can’t afford basic necessities and struggle to get the basic things they need…every cent that they’re paying is significant… those products are already expensive and you’re putting an extra burden on people who can’t handle it,” she explains. But beyond the financial aspect, repealing the tampon tax is simply an issue of equality. “Menstruating is not an option. To function in society and stay sanitary, women need these products. By not taxing them, you are admitting to the necessity of them,” says Katie Dunbar, a resident of Perkasie, Pennsylvania.

The tampon tax is a problem, but there are solutions. The Alliance for Period Supplies is an organization that has resources for those who are struggling to get the menstrual products they need. In addition, they share how you can contact your state legislators to voice your concern about this tax and explain alternatives to eliminating the tampon tax, such as Medicaid covering the cost. The United States is a first-world country, and its residents are fortunate to have access to necessary healthcare items. However, it’s time to eliminate the gender discrimination around menstrual products.

Sources:

https://www.statista.com/statistics/1423973/us-states-with-tampon-tax/

https://allianceforperiodsupplies.org/wp-content/uploads/2023/10/Tampon-Tax-Toolkit.pdf

https://www.nytimes.com/2023/09/01/well/live/tampon-tax-texas.html